How To Trade Red To Green Moves Youtube

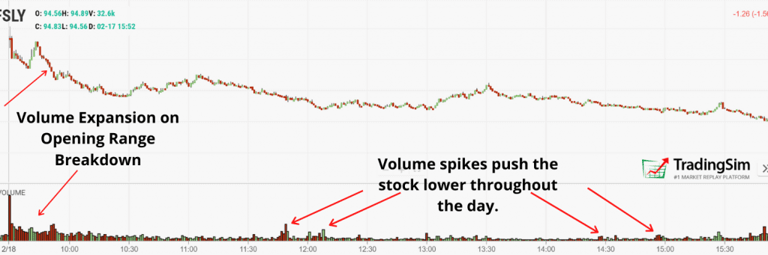

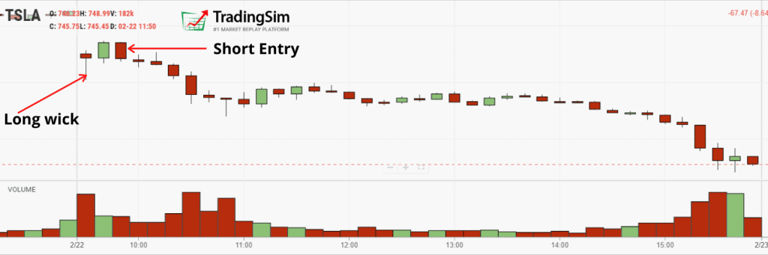

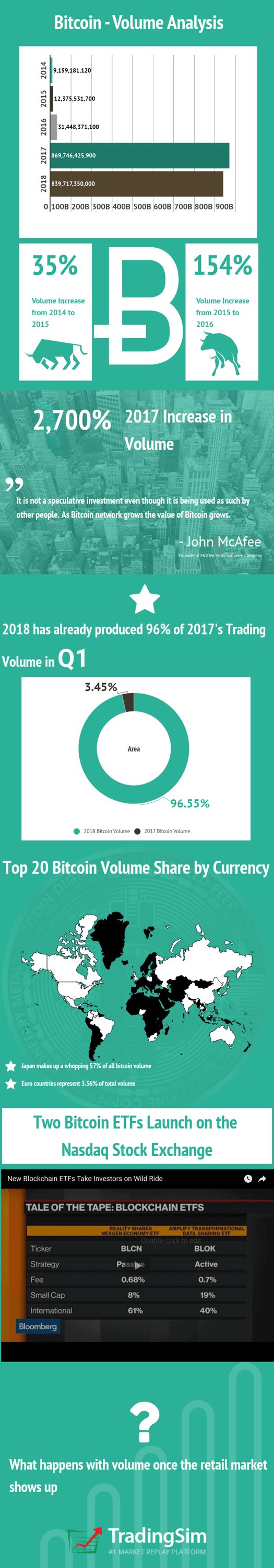

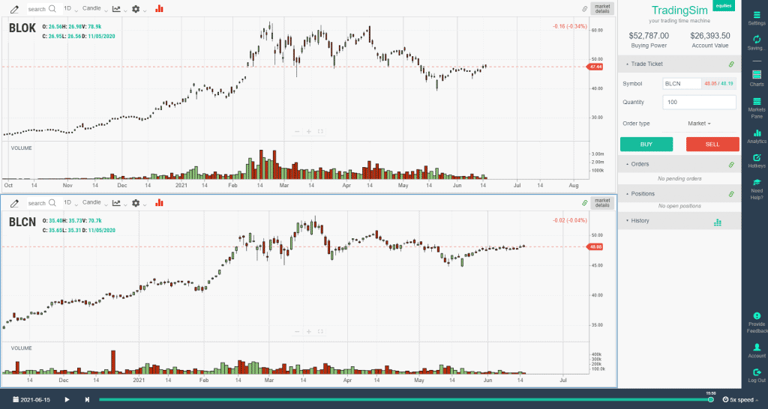

Book assay is the technique of assessing the wellness of a trend based on volume action. In fact, volume is one of the oldest day trading indicators in the market. The volume indicator is the most popular indicator used past market place technicians likewise. Trading platforms may lack certain other indicators; even so, you would be hard-pressed to find a platform that does not include volume. In addition to technicians, fundamental investors also clarify volume — taking notice of the number of shares traded for a given security. This gives them a sense of the supply and need present. Regardless of your style of trading or investing, book analysis [1] is one of the simplest methods for observing ownership and selling activity of a stock at key levels. Even so, not all volume readings are straightforward. Many times volume can provide conflicting messages. To that finish, your ability to assess what volume is telling you in conjunction with cost action can be a primal factor in your ability to turn a profit in the marketplace. In this commodity, we will cover how to assess the volume indicator to help usa determine the market's intentions across four common day trading setups: In addition, nosotros will hash out advanced book analysis techniques and apply these methods to assess the force of the equities and bitcoin markets. But before we do, have a few minutes to prime yourself for the content below past watching this video on volume analysis: Very simply, volume represents all the recorded trades for a security during a specified period. This specified period can range from monthly charts to 1-infinitesimal charts and everything in between. Most trading platforms, Tradingsim included, print each volume bar as either green or cherry. Green bars are printed if the stock closes upward in price for a menses and red bars bespeak a stock closed lower for a given period. This color-coding need not hateful there was more than "downward or upwards" volume for the catamenia; it only represents how the stock airtight. One do good of book analysis is that information technology cuts through much of the dissonance in the Level 2 montage. It does and then by giving you a visual representation of where traders are really placing their coin. Breakout trades are arguably the near recognizable strategy in all of trading. Every retail and professional trader knows from day one how to anticipate them. The strategy is simple. There are 2 cardinal components to confirm a breakout: price and volume [2]. Along those lines, when stocks break critical levels without book, you should consider the breakout suspect and prime for a reversal off the highs/lows. The beneath chart is of Facebook on a 5-minute time interval. You volition observe that Facebook was up ~15% throughout the mean solar day after a pregnant gap up. Can you tell me what happened to Netflix later on the breakout of the early 2015 swing high? Information technology just so happens that FB was making a new loftier on the daily chart, an best loftier to be verbal. When you look for stocks that are breaking highs, just await for heavy book. Book that exceeds 100% or more of the average book over the prior 30-ninety days would exist ideal. Nevertheless, a stock making a new a high with 50% or lxx% less book might still work. If nosotros are inside the margins, delight practice not beat yourself up over a few 1000 shares. In a perfect world, the book will expand on the breakout and let yous to bag most of the gains on the impulsive move higher. Below is an example of this scenario on an AMD breakout using the 1m nautical chart. Hopefully this helps visualize what is happening intraday on these breakouts. On that token, let's test to see if you are picking upwardly the concepts of breakouts/breakdowns with book. Take a await at the below chart without scrolling too far. Tin can yous predict if the stock will go along in the direction of the trend or reverse? Come on, don't crook! Ok, now you tin wait: The correct respond to the question is this: you really take no idea if the stock volition accept a valid breakout. Withal, from the chart you could encounter that the stock had squeamish downward pressure on high volume and merely one green candle before the breakdown started taking identify. This is where experience and money management comes into play, because you lot have to take a take chances on the trade. You would have known y'all were in a winner once y'all saw the volume pick upwards on the breakdown every bit illustrated in the nautical chart and the price activeness began to break down with ease. This concept of increasing volume on a breakout was as well stated in the book Mastering Technical Assay. In one extract, author Alan Northcott discusses how "[Charles] Dow recognized the importance of volume in confirming the strength of a trend. While a secondary indication, if the volume did not increment in the management of the tendency, this was a alert sign that the trend may not exist valid." [3] As always, if y'all take a breakout trade, be certain to place your stops slightly below the high to ensure you are non caught in a trap. This strategy works for both long and short positions. The primal is looking for the expansion in volume prior to inbound the trade. Go along these in mind: When a stock is moving higher in a stair-step approach, you will want to see volume increase on each successive loftier and decrease on each pullback. The underlying bulletin is that at that place is more positive volume as the stock is moving higher, thus confirming the health of the trend. This sort of confirmation in the volume action is commonly a issue of a stock in an impulsive phase of a trend. The volume increase in the direction of the chief trend is something you will generally see as stocks progress throughout the day. You will see the strong motion into the 10 am time frame, a consolidation flow and so acceleration from noon until the close. For this strategy, y'all will want to await for the trade to develop in the morning and look to take a position later on eleven am. The thought is to wait for the trend to form, then follow it with a low risk entry indicate. As the stock moves in your favor, you lot should continuously monitor the book activity to run into if the move is in jeopardy of reversing. The speed of this setup is much slower versus the other strategies discussed in this article; withal, the difficulty reveals itself in the increased number of false moves, which can exist commonplace in the afternoon. To help railroad train your chart eye, hither are a few examples of "joining the trend" that didn't work very well. Along these lines, it'due south always best to have stops in play. It never pays to force a trade. Hither, JKS failed to go on breaking down and simply went sideways into the close: And here is another case of a breakout that simply goes sideways as well. These charts are just a sample of what happens far too ofttimes when it comes to afternoon trading. Non all stocks will keep trending all 24-hour interval. Information technology'south but a take chances yous must have when trading late day setups. In that location are some exceptions to this with low float stocks, which we bear upon in our vwap boulevard article. Volume spikes are often the upshot of news-driven events. But regardless of the cause, the spike is worthy of studying in relation to toll action For all intents and purposes, nosotros ascertain a spike equally an increase of 500% or more in volume over the recent volume average. This book spike will oftentimes pb to sharp reversals since the moves are unsustainable due to the imbalance of supply and demand. Trading counter to book spikes tin can be profitable, but it requires enormous skill and mastery of volume analysis. These volume spikes can likewise exist an opportunity for you as a trader to take a counter move position. You need to know what you are doing if yous are going to trade volume spikes. The action is swift and yous have to keep your stops tight, but if y'all fourth dimension it right, you can capture some squeamish gains. Let'southward walk through a few volume spike examples, which resulted in a reversal off the fasten loftier or depression. In the below example nosotros will cover the stock Amazon. The stock had a meaning gap $20. Notice how the stock never fabricated a new loftier even though the volume and price action was nowadays. This is a key sign that the bears are in control. Another setup based upon volume spikes candlesticks with extremely long wicks. In this scenario, stocks will frequently retest the depression or high of the fasten. You can take a position in the direction of the primary trend later the stock has had a nice retreat from the initial book and cost spike. Below is an another example from a three-minute nautical chart of the stock Amazon, ticker AMZN. You will notice how the stock had a significant gap down and so recovered nicely. Once the recovery began to flatline and the book dried upwardly, you will want to establish a brusk position. Let'south have another look at a long wick setup. The beneath chart is of Tesla, ticker TSLA with a long wick down. The stock and so recovered and flattened out, which was an excellent time to enter a curt position. We'd be remiss if we didn't touch on the topic of failed breakouts. As a day trader, you're going to take your fair share of trades that just don't work out. It'southward just part of the game. So, how practice you know when a merchandise is failing? Uncomplicated answer – yous tin meet the warning signs in the volume. Let's dig into the charts a bit. In a higher place is the chart of Chipotle Mexican Grill. You can run into the stock attempted to break out in the kickoff 60 minutes of trading. Notice how the volume on the breakout try started with good effort, just and then faded off. With this signature, you shouldn't exist surprised when the stock begins to float sideways with no real purpose. While this would have been a break even merchandise, more or less, your money is idle. At least yous wouldn't take taken a loss on this 1. The side by side example was worse. The above case of DKNG failed to follow through to the downside, despite gapping downwards on considerable volume. Notice how the volume dries up as the stock attempts to brand a lower low on the day and break the first bar. The key is to go out if the price activity begins to chop sideways for many candles. When you sit in a stock hoping things will go your way, you are better off making a donation to charity. At least the money will go to a worthy cause. The strategies discussed in this article can be used with any stock and on any time frame. The nearly important signal to call up is you want to encounter volume expand in the direction of your trade. Continue this in the back of your heed and you volition practice only fine. So far in this commodity, we accept covered how to apply volume analysis to identify trading opportunities for day trading. However, volume can be and is so much more than. To demonstrate the ability to analyze long-term trends, we volition use book to unpack the roaring cryptocurrency market. Take a look at the infographic beneath where nosotros have done some all-encompassing research on volume trends across a four-yr period of Bitcoin. The answer to the question in the infographic has plainly been answered. In 2021 Bitcoin striking a record price of $64900. However, the real story in the infographic, which may non have jumped out is Japan makes upwards 57% of all the trading volume for Bitcoin, while only accounting for 1.vii% of the global population. Granted, wealth is largely full-bodied in the G8 countries, but this sort of multiple is a bit ridiculous. Early indications show that Japanese retail investors, generally in their 30s and 40s are using leveraged accounts to trade cryptocurrencies. This surge of greenbacks inflows into the cryptocurrency market has resulted in the bitcoin bravado out tape subsequently record. While there is significant speculative trading going on to drive up the cost, we cannot ignore the enormous value bitcoin may have in a global economy. Shifting our focus dorsum on the charts. Let's take a look at the trading functioning of two Blockchain ETFs. The tickers for these ETFs are BLOK and BLCN. Do not be confused in thinking you lot are buying into the actual cryptocurrency market if you purchase these ETFs. In instance y'all missed the video in the above infographic, the SEC has non approved ETFs that invest straight in the cryptocurrency market. Sounds a scrap disruptive right seeing how one of the ETF'due south name is BLOK. The two ETFs have stocks that are directly connected to the crypto industry. In both ETFs, you will find familiar names like Overstock, IBM, Square, and Nvidia. Enough rambling about the makeup, let's have information technology to the charts. From the looks of things, there is little value in ownership both ETFs for diversification as they are mirror images of i another. These similarities are still relevant in the realm of volume. Discover how both BLOK and BLCN have enormous volume into the climactic push to new highs dorsum in March. This coincides with Bitcoins highs as well. ETFs can be a good way for someone to get involved in the world of crypto, without buying an actual cryptocurrency. Now, with that said, if yous are looking to take a long shot over the next 5 to ten years, these ETFs are not going to give you the desired home run affect you lot are looking for. Shifting gears back into volume analysis with stocks, the next bonus technique we would like to embrace is using a volume overlay with the price. The overlay is slightly different from printing book on the x-axis by allowing yous to see where the concentration of orders took identify. This tin provide yous with a articulate view into where there are many traders and you can then employ this to validate a particular support or resistance level. The uncomplicated way of determining where to focus your attention is on the longest volume bar. Practise you see how this view lets yous know where all the trades were made for a given security? This layer of information is invisible with volume underneath the chart. One slight twist to this indicator that you might want to try out is to combine these key volume levels with Fibonacci. Discover in the to a higher place nautical chart of Bitcoin futures that there was significant support effectually $30,000 recently. This coincided with a 100% retracement off the highs. You tin also meet that pregnant back up and resistance are occurring around the 38.two%, 50%, and 61.8% levels. The indicate is y'all practice not simply want to employ volume and toll activity. It is also great to add another validation technique like Fibonacci to the chart to proceeds clues of where the price is probable to break. These, folks, are non natural price movements for the alphabetize in historical terms. On the slow run-up, there are many cost swings, some of which might have thrown yous for a loop in the concluding 3 years. Pregnant, it would have taken serious cocky-control to stay in the trade. However, once yous overlay the volume you will see in that location are three key levels: 25,500, 27,000, and thirty,000. The 25,000 level has the near volume over the concluding iii years. The alphabetize formed a dainty triple bottom over a 24-month period leading upwards to the pause of 27,000. For all the Wyckoff traders, the back and forth at the 25,000 level created a ton of cause, which ultimately fueled the rally. The next level is 27000. Notice how the volume at the 27,000 level is high, just in relative terms over the concluding 3 years, the volume is light. This is because the run-upwards to the high over 26,000 was done on light volume. Once 27,000 was broken, the Dow so ran upwards to over 30,000. The Dow is now bouncing around the 35,000 level. In relative terms, the 35,000 level is now the high-level volume zone which may act every bit resistance. Are you lot now able to encounter how volume on top of toll allows you to cut through all the head fakes to see the aforementioned levels the smart money cares about? Volume alone cannot provide you buy and sell signals. Volume can, however, provide you with further insights into the internal health of a trend. Think, you lot can await at the volume on the x-centrality (time) and on the y-axis (price) to identify potential changes in trend and support/resistance levels. In addition, check out this post on volume from the Liberated Stock Trader. He does a great job highlighting the concepts of PUVU, PUVD, PDVU, and PDVD. If interested in what these terms hateful, yous should visit his site. Tradingsim accelerates the steep learning bend of condign a consistently profitable trader by assuasive you to replay the market as if you lot were trading alive on any day from the last 3 years. It's really a trading fourth dimension automobile! To see how Tradingsim tin help meliorate your bottom-line, please visit our homepage.

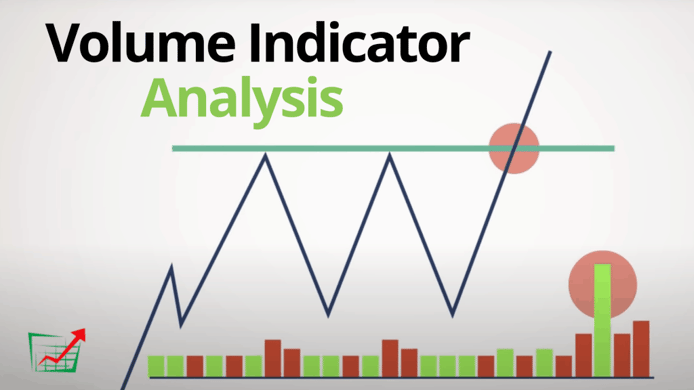

Why is Volume Analysis Important?

What is Volume?

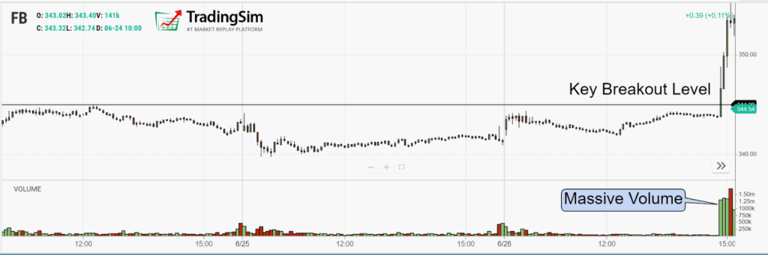

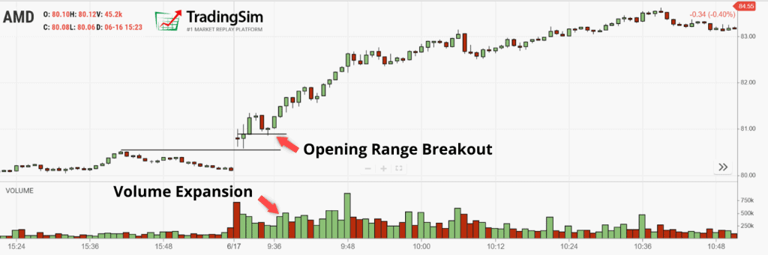

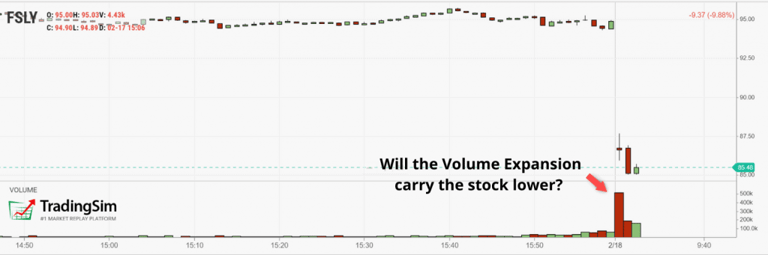

Strategy one: Breakouts and Volume

Breakout Example 1:

Breakout Example 2:

Test Instance

Quick Summary

Strategy 2: Trending Stocks and Volume

Trending Example 1:

Failed Examples

In Summary

Strategy three: Volume Spikes

In Summary

Volume Spikes with Long Wicks

In Summary

Strategy 4: Trading the Failed Breakout

In Summary

4 Strategies Determination

Bonus Content – Bitcoin Volume Analysis

Volume Assay for Ii Blockchain ETFs

Overlay of Volume on Cost

3-Twelvemonth Dow Jones Analysis

In Summary

Permit's Improve Your Trading Performance

External References

Source: https://www.tradingsim.com/day-trading/volume-analysis-technical-indicator

Posted by: holleyseentrusels.blogspot.com

0 Response to "How To Trade Red To Green Moves Youtube"

Post a Comment